$ 79.95

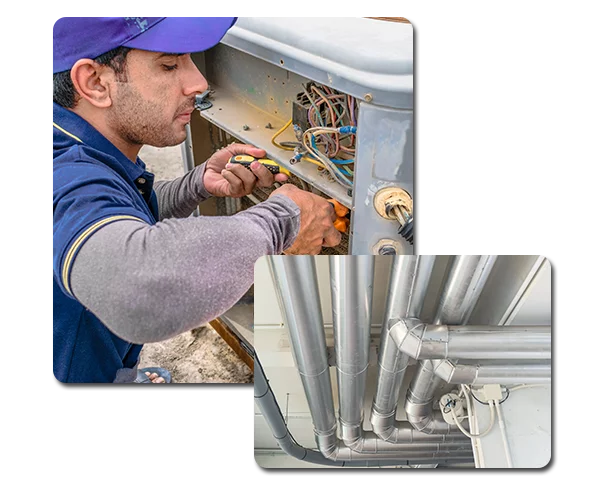

AC TUNE-UP

HVAC Special

Must be presented at the time of service. Can not be combined with any other offer.

Serv Tech Air Conditioning Solutions is a fully licensed and insured HVAC company. Our expertise extends to a variety of top brands, including Carrier, Trane, Lennox, Rheem, American Standard, York, Bryant, Ruud, Daikin, Mitsubishi, Gree and many more. With a commitment to high-quality service, we offer same-day, budget-friendly HVAC services to meet your needs.

Serv Tech Air Conditioning Solutions - Central Air Conditioning Installation - Top Brand, high-efficiency AC unit and professional installation services in both Broward and Palm Beach areas. Being fully licensed and insured, we provide unbeatable deals and great guarantees on air conditioning units, including Smart Home AC Unit Installation

Serv Tech Air Conditioning Solutions, a licensed and insured provider, specializes in Air Conditioning Replacement and offers unbeatable deals on top-of-the-line, high-efficiency, Top Brand AC Units in the Broward and Palm Beach regions. Our great guarantees and options for Smart Home AC Unit Installation make us the go-to choice for quality and affordability.

Serv Tech Air Conditioning Solutions is a licensed and insured HVAC company specializing in Commercial AC Maintenance, offering yearly plans to keep your air conditioning units running at peak performance in the Broward and Palm Beach areas. Our preventative maintenance services are designed to minimize the risk of AC breakdowns and ensure optimal functioning year-round.

Serv Tech Air Conditioning Solutions, a licensed and insured specialist in residential AC Maintenance, provides annual maintenance plans tailored for homes and condos in the Broward and Palm Beach areas. Our proactive air conditioning services ensure that your central AC units operate at their best while reducing the risk of unexpected breakdowns.

We provide same day AC Repair and AC Services, we are licensed, insured and service Fort Lauderdale, Boca Raton and throughout Broward and Palm Beach county. Earning top ratings, as evidenced by Google reviews. With experienced and Certified HVAC Technicians, we will resolve Air Conditioning issues correctly on the first attempt. Call us today and schedule your Air Conditioning service, We repair Air Conditioning units for both residential and commercial properties.

Serv Tech Air Conditioning Solutions is a locally owned and family-operated HVAC company situated in Broward and Palm Beach County. We are proud to hold comprehensive licensing and insurance, providing you with the assurance of our dedication to excellence and professionalism. We offer same-day air conditioning services, encompassing AC repair, AC installation, and AC maintenance. At Serv Tech Air Conditioning Solutions, we proudly serve Broward County and Palm Beach as your trusted HVAC experts. Our team comprises highly skilled HVAC technicians who are heating and cooling specialists, proficient in a wide array of services. Our offerings range from AC repair and AC installation to furnace maintenance and air conditioning services. We excel in handling emergency HVAC repairs, ductless mini-split installations, and indoor air quality improvements. Our services also encompass HVAC tune-ups and inspections, guaranteeing optimal system performance. As your dependable heater repair specialists, we cater to commercial HVAC needs, provide energy-efficient HVAC systems, and offer round-the-clock emergency repair services. We understand your financing concerns and provide HVAC financing options to meet the needs of both residential and commercial HVAC projects. Whether it's heat pump repair and installation, thermostat upgrades, or HVAC preventive maintenance, Serv Tech is your go-to solution. Reach out to us today for service. Our air conditioning services are available in Broward and Palm Beach County, serving residential, commercial, and industrial properties in Fort Lauderdale, Boca Raton, and throughout the entirety of Broward County and Palm Beach.

Reliable AC repair services in Broward County and Palm Beach County. Available 365 days, ensuring your comfort in every season. We provide same-day AC services, ussually within 2 hours.

Serv Tech Air Conditioning Solutions will analyze and your AC Unit, check if parts are still under warrantee and give you a friends and family price quote.

Serv Tech Air Conditioning Solutions has been in business for over a decade. we are fully licensed and insured HVAC company in Broward and Palm Beach - Call us today.

Serv Tech Air Conditioning Solutions provides leading brand, high-efficiency air conditioning units at budget friendly prices, with our certified HVAC technicians ensuring a professional, clean installation. We do it right the first time. – Contact us Today!

Serv Tech Air Conditioning Solutions offers a comprehensive range of top-brand air conditioners, providing fast, reliable, and friendly sales and installation services for all your HVAC needs.

Choose Serv Tech Air Conditioning Solutions for guaranteed professional and top-quality air conditioner installation services, ensuring your utmost satisfaction.

Copyright Serv Tech Air Conditioning Solutions © 2024. All Rights Reserved.| Sitemap | Palm Beach | Broward